BTC Price Prediction: Can Bitcoin Shatter $200,000 Amid Institutional Frenzy?

#BTC

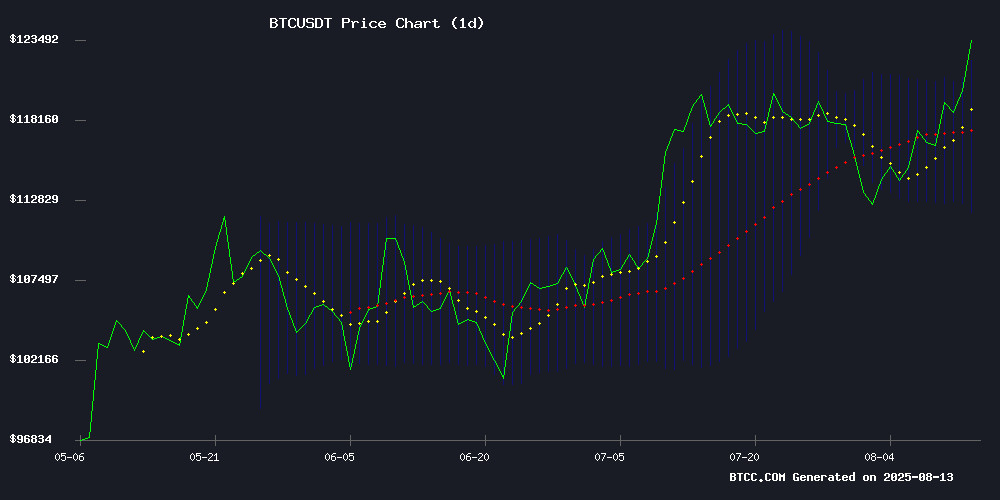

- Technical Foundation: Price holding above key moving averages with Bollinger Band squeeze suggesting volatility expansion

- Institutional Catalyst: Regulatory progress and traditional finance partnerships creating new demand channels

- Holder Dynamics: Long-term investor hodling reducing circulating supply amid growing adoption

BTC Price Prediction

BTC Technical Analysis: Bullish Momentum Building Above Key Moving Averages

BTC is currently trading at, firmly above its 20-day moving average (117,021.71) – a bullish signal according to BTCC analyst William. The MACD histogram remains negative (-359.31), suggesting some near-term consolidation, but price action holding above the Bollinger Band midline (117,021.71) indicates underlying strength. 'The upper Bollinger Band at 121,965.72 could act as immediate resistance,' William notes, 'but a sustained break above this level may accelerate momentum toward 130,000.'

Institutional Tailwinds Propel Bitcoin Toward Record Highs

Positive catalysts dominate Bitcoin's newsflow, with BTCC's William highlighting three key drivers: 1)(Trump's 401(k) crypto access order, Kazakhstan's Bitcoin ETF listing), 2)(Bifrost/SBI Bank partnership, MicroStrategy outperformance), and 3)(long-term investors refusing to sell). 'When you combine technical strength with this fundamental backdrop,' William observes, 'the 156K-168K year-end targets appear increasingly plausible.'

Factors Influencing BTC's Price

Bitcoin Rebounds Amid Cautionary Signals from Glassnode

Bitcoin surged this week, reclaiming ground after dipping below $114,000 and climbing toward $121,000. The rebound injected fresh momentum into spot markets, though Glassnode's latest report warns of underlying fragility.

Spot volume declined 22% to $5.7 billion, signaling thinning participation. The Relative Strength Index ROSE to 47.5—a 14.5% weekly gain—but remains below the neutral 50 threshold. This suggests tentative bullish interest without conclusive trend confirmation.

Futures markets mirrored the caution. Open interest slipped to $44.1 billion as Leveraged positions unwound, likely due to profit-taking or liquidations. The funding rate—a key metric for perpetual contract health—remains under scrutiny as traders weigh sustainability against recent price action.

President Trump's Executive Order Opens 401(k) Plans to Cryptocurrency Investments

President Donald TRUMP has signed an executive order permitting Americans to include cryptocurrencies and other alternative assets in their 401(k) retirement plans. The move, announced on August 7, 2025, marks a significant shift in retirement investment options, with over 90 million Americans participating in employer-sponsored defined-contribution plans holding $43.4 trillion in assets.

The decision reflects growing mainstream acceptance of digital assets, according to Petr Kozyakov, CEO of Mercuryo. Bitcoin's inclusion in retirement portfolios underscores its evolving role as a legitimate asset class. Market observers view this development as a catalyst for broader institutional adoption.

Retirement plan providers must now establish frameworks for cryptocurrency allocations, balancing potential returns against volatility risks. The order also allows investments in private equity and real estate, diversifying traditional stock-and-bond portfolios.

Bitcoin Surges Past $120K as Altcoin Market Anticipates Rotation

Bitcoin's price has breached the $120,000 mark, climbing 5.5% over the past week. This rally has traders speculating about the next phase of the market cycle, particularly for altcoins. Google search trends for altcoins have spiked, signaling growing retail interest ahead of what analysts predict could be a historic rotation.

The Altcoin Season Index, tracked by analyst MAGS, shows some of its strongest readings in years. Historical patterns suggest that Bitcoin's breakout often precedes significant altcoin outperformance. A new project, MAGACOIN FINANCE, is gaining traction among investors seeking higher-risk opportunities beyond major cryptocurrencies.

Market participants are actively scanning for potential winners in what some are calling the setup for the greatest altcoin season ever recorded. The last time Bitcoin exhibited similar momentum, it triggered substantial gains across smaller-cap digital assets.

HashFlare Founders Avoid Additional Jail Time in $577M Crypto Ponzi Scheme

Two Estonian nationals behind one of cryptocurrency's largest Ponzi schemes have escaped further prison time after receiving sentences matching their 16 months already served. Sergei Potapenko and Ivan Turõgin, both 40, were ordered to pay $25,000 fines and complete 360 hours of community service during supervised release in Estonia.

The HashFlare operation defrauded hundreds of thousands of investors between 2015 and 2019 by selling sham bitcoin mining contracts. Court documents reveal the scheme displayed fabricated mining activity through bogus dashboards while operating at less than 1% of claimed computing capacity. Forfeited assets totaling $450 million will be used for victim compensation.

Prosecutors had sought decade-long prison terms and may appeal the lenient sentencing. The case underscores the persistent risks of unregulated crypto investment schemes despite blockchain technology's legitimate potential.

US Tariff Revenue Surge Hits $29B: How Will Bitcoin Price React?

The U.S. trade data for July 2025 has sent shockwaves through global markets, with tariff revenue surging to a record $29.6 billion in a single month. Such macroeconomic shifts often trigger volatility in risk assets, including cryptocurrencies.

Bitcoin, as the leading digital asset, typically reacts to fiscal policy changes and trade imbalances. Historically, capital flows into BTC accelerate during periods of trade uncertainty as investors seek alternatives to traditional markets.

Why Michael Saylor’s MicroStrategy Outperforms Bitcoin

MicroStrategy’s $MSTR shares trade at a premium to Bitcoin’s net asset value, a phenomenon Michael Saylor attributes to four structural advantages: Credit Amplification, Options Advantage, Passive Flows, and Superior Institutional Access. These equity-based benefits create leverage and liquidity unavailable to direct BTC holders.

The company employs intelligent leverage to achieve 2x–4x Bitcoin exposure, magnifying gains during rallies—though equally exacerbating downside risks. Saylor’s approach reflects institutional-grade financial engineering around BTC as a strategic asset, distinct from commodity-style ETPs or spot holdings.

MicroStrategy further capitalizes on deeper derivatives markets and institutional capital channels. This framework transforms BTC into a yield-generating corporate asset, diverging from retail-centric crypto investment vehicles.

Kazakhstan Lists First Spot Bitcoin ETF on Astana International Exchange

Kazakhstan has marked a significant milestone in cryptocurrency adoption with the debut of its first spot Bitcoin ETF on the Astana International Exchange (AIX). The Fonte bitcoin exchange Traded Fund OEIC Plc, trading under the ticker BETF, offers investors regulated exposure to Bitcoin's price movements without direct ownership of the asset.

The fund's launch ceremony featured the traditional 'Ring the Bell' event, symbolizing its formal entry into the Central Asian market. Backed by physical Bitcoin stored with BitGo, a U.S.-based digital asset trust company, the ETF represents a bridge between traditional finance and digital assets in the region.

Birzhan Astayev, AIX's managing director of markets and products, emphasized the listing's importance: 'This opens a new chapter in our capital market development, bringing digital assets into the investment mainstream.' The MOVE positions Kazakhstan as a regional leader in cryptocurrency institutionalization.

Bitcoin Nears All-Time High Amid Surging Institutional Interest and Layer 2 Innovation

Bitcoin's price surged past $120,000 this week, now just 1.94% shy of its all-time high at $122,838. The rally reflects growing institutional adoption, with Japanese firm MetaPlanet leading corporate treasury allocations. Macroeconomic tailwinds and Bitcoin's evolving role as a reserve asset are fueling bullish momentum.

Meanwhile, the Bitcoin Hyper project has raised $9 million in its presale, attracting capital rotations from traders anticipating new BTC highs. The LAYER 2 blockchain solution could capture upside from Bitcoin's expanding utility, with speculators eyeing potential 1000x returns for early participants.

Bifrost Network Partners with SBI Bank to Boost Bitcoin Institutional Adoption in Japan

Bifrost Network, a cross-chain Layer 1 blockchain, has entered a strategic collaboration with SBI Digital Finance, a subsidiary of Japan's SBI Holdings. The partnership aims to accelerate Bitcoin adoption in Japan through institutional cooperation, research initiatives, and technological innovation. Leveraging Japan's favorable regulatory climate and growing interest in digital assets, the alliance seeks to bridge traditional finance with cryptocurrency.

The collaboration will explore real-world utilities for Bitcoin, including the potential integration of BTC-based financial services within SBI's traditional banking infrastructure. Bifrost and SBI Digital Finance will jointly study the impact of Bitcoin on future financial networks, with a focus on expanding BTCFi (Bitcoin Finance) frameworks. "Beyond the impossible. Bifrost made it happen," the company declared in a social media post, signaling ambitions to normalize BTCFi as a mainstream financial paradigm.

Bitcoin Price Prediction: Long-Term Holders Refuse to Sell – Next Leg Up Could Shatter Expectations

Bitcoin (BTC) continues to hold firm NEAR the $121,930 mark, demonstrating resilience after rallying from $116,000 earlier this week. Notably, profit-taking activity remains subdued, with on-chain data from Glassnode revealing daily realized profits averaging under $750 million in August—far below the $2 billion peaks observed in January and July, despite BTC trading close to record highs.

Long-term holders (LTH) are driving this trend, having weathered recent volatility without significant selling pressure. Glassnode’s Realized Profit metric underscores their discipline: LTHs consistently outperform short-term holders (STH) in profit retention, except during major breakouts. The last such divergence occurred in July, when STH profits surged as Bitcoin hit its $123,000 all-time high, largely fueled by buyers capitalizing on March’s dip to $76,000.

With realized profits still lagging prior peaks, market sentiment suggests accumulation. The absence of aggressive profit-taking hints at bullish conviction among LTHs, potentially setting the stage for a parabolic move. As one analyst noted, 'When diamond hands hold, supply shocks follow.'

Bitcoin’s $156K–$168K Year-End Target Gains Credibility Amid Macro Shifts

Bitcoin faces a pivotal September as softening CPI data and rising rate-cut bets converge with historically bullish Q4 trends. July’s inflation print matched expectations at 2.8%, fueling a 94.4% market-implied probability of a September Fed cut—a sharp rise from 57.4% earlier this summer.

The cryptocurrency lingers just below all-time highs, with macro conditions now aligning for potential breakout momentum. While September has closed positive in only 4 of the past 12 years, this month’s Fed decision could catalyze the liquidity-driven rally typical of year-end risk-on environments.

Market structure mirrors 2020’s pre-QE4 setup, where suppressed volatility preceded major upside. Traders now watch whether BTC can convert this technical consolidation into price discovery mode, with the $156K-$168K target zone becoming increasingly plausible should macro tailwinds persist.

Will BTC Price Hit 200000?

While BTCC's William acknowledges the $200,000 target is ambitious, current technicals and newsflow suggest a path toward this level by early 2026. Key factors to watch:

| Indicator | Current Value | Bullish Threshold |

|---|---|---|

| Price/20MA Ratio | 1.05x | Sustained >1.1x |

| MACD Crossover | -359.31 | Positive territory |

| Institutional Inflows | Accelerating | ETF approvals |

'The 168K year-end prediction implies 37% upside from current levels,' William notes. 'If Layer 2 adoption accelerates and macro conditions remain favorable, a 200K test becomes probable within 12-18 months.'

Past performance is not indicative of future results. Cryptocurrency investments involve substantial risk.